Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

When your bank account is depleted, a $35 insufficient funds charge hits hard. And you involuntarily contribute to the $15.5 billion pool of money banks collect from Americans in overdraft charges.

Brigit is an app that offers to help users avoid falling into the overdraft trap. It can also help improve your finances through cash advances, credit building, and budgeting. But at $9.99 per month, is it worth it? Here’s our full review.

What Is Brigit?

Brigit is well established on the financial technology scene, founded in 2017, and backed by celebrity investors Ashton Kutcher and Kevin Durant. While Brigit reports saving their users over $435 million dollars in fees since they launched, this isn’t their only mission. The app aims to give everyday Americans an entire, holistic financial makeover with the following features:

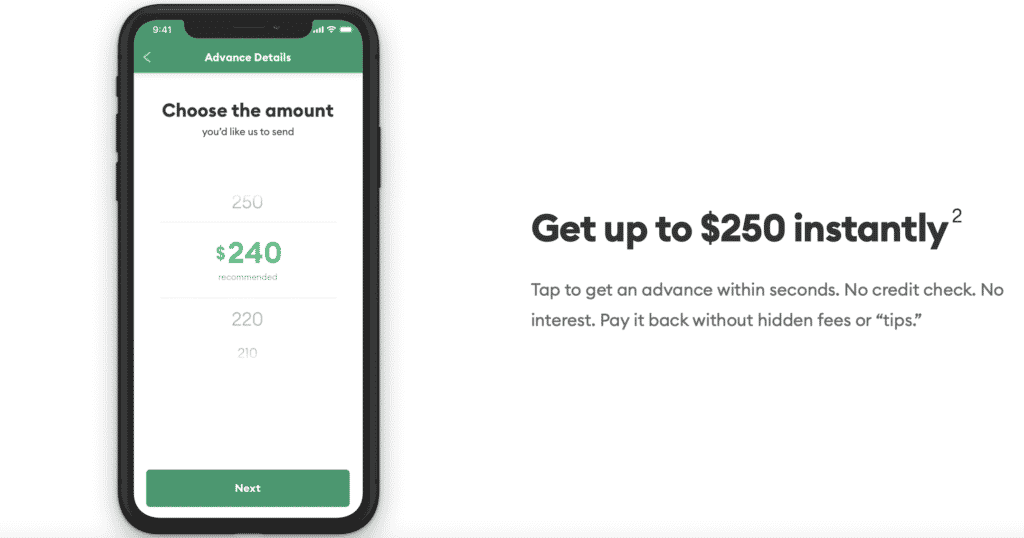

- Cash advance: Brigit users may qualify for a zero-interest, no-fee cash advance from $50 to $250. There are also auto-advances to keep your bank account from being overdrawn.

- Credit building: A strong credit score is key to opening the doors of favorable interest rates on vehicles, mortgages, and most loans. We’ll tell you how Brigit’s credit-building account works below.

- Budgeting: For those of us who dread sorting through spreadsheets to confront our budget, Brigit makes it simple. Your expenses are broken down into graph form, separated into categories, and presented in percentages. The visuals are easy to digest, and you get a quick view of where you’re overspending. The app even recognizes patterns in your spending month to month and lets you know when you’re noticeably overspending in a certain category compared with previous behavior.

- Find jobs: When you boost your income, you create more opportunities for saving and paying off debt. Brigit connects its subscribers to money-making opportunities, from signing up for DoorDash Delivery to completing online surveys.

How Does Brigit Work?

After downloading Brigit, you’ll be asked to connect your U.S.-based bank account. The app prompts are easy and quick to follow, and your sensitive information is protected by 256-bit encryption. In just a few minutes, Brigit

- Review your deposit and expense history

- Programs predictions and alerts for low account balance

- Calculates the amount of cash advance they can offer

Immediately Brigit has the capability to let you know if you’re in danger of overdrafting your account. However, an instant cash advance won’t be so instant for everyone.

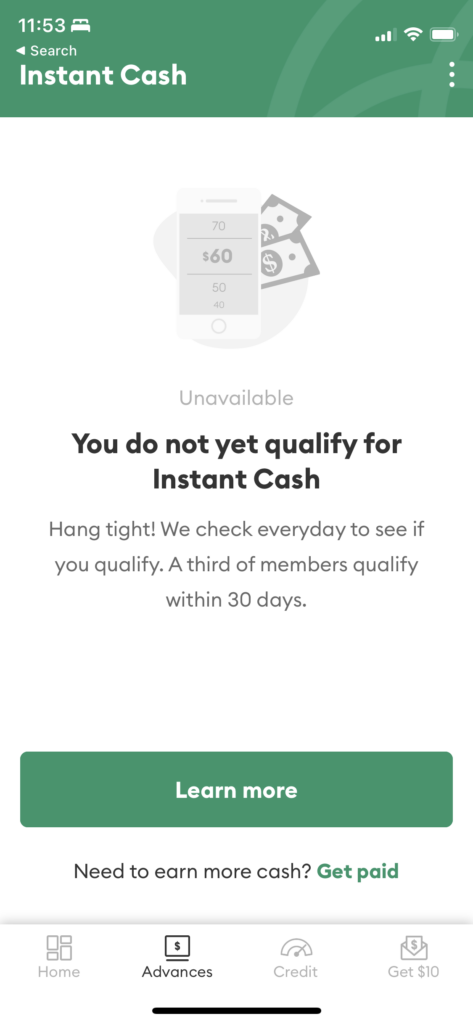

Some Brigit users may qualify for an instant cash advance upon signing up, in an amount based on their Brigit score. These users likely have a simple income setup, where a single employer pays them on a predictable basis. For others who have many streams of income, cash advance qualification could come later, or not at all. Thirty-three percent of Brigit users qualify within 30 days, and the Brigit app updates your qualification status daily.

The Brigit Score and Cash Advances

Once qualified, you get a Brigit score from 40 to 100. This score determines how much cash advance you can get from $50 to a maximum of $250. The Brigit score is a composite number that reflects your financial health based on the following:

- Bank account health: the age of your bank account, frequency of use, and average balance

- Earnings profile: size of deposits, frequency of deposits, and history of deposits from a single employer

- Spending behavior: income to expense ratio and history of on-time bill payments

Next, you can request and receive cash instantly. And by instantly, we mean in about 20 minutes. To access cash this quickly, you’ll need to link your debit card. Without a linked card, an ACH transfer can deposit the cash advance into your bank account in one to three business days.

Your advance comes with no fees, no interest, and there’s no voluntary “tip” feature other cash advance apps “encourage” their borrowers to use as a thank you. But you are on the hook for the $9.99 monthly app subscription fee.

Paying Back the Advance

Brigit selects a repayment date based on your pattern of receiving income deposits and automatically withdraws the advance amount on that date. You’ll receive a reminder two days before your repayment date, and you can always pay back your advance manually within the app beforehand. You can only take out one cash advance at a time. Once your repayment has been processed, you’re eligible to receive another advance.

Brigit Credit Builder Account

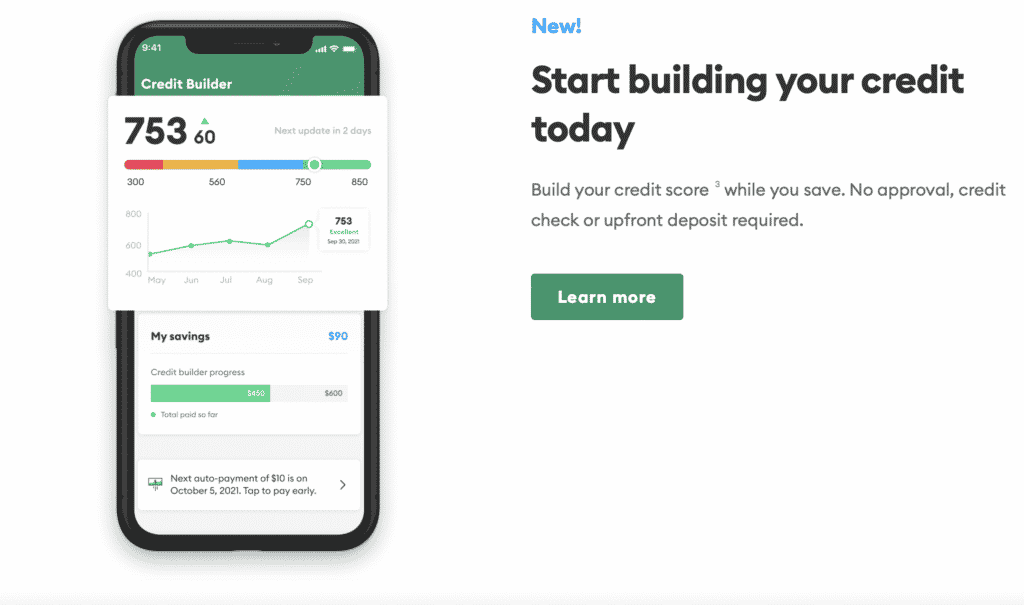

Where other cash advance apps have a singular focus on getting you an advance before payday, Brigit differs in offering a way to improve your credit. We’ll go further into the pricing below, but we do feel you need to make use of all of Brigit’s services, including this one, for the app to be worth the price.

When I checked out the credit builder feature, Brigit offered me a $600 installment loan to improve my less-than-perfect credit score. When opening a credit-builder account, you have the option to choose how much you want to pay monthly toward this loan from your regular checking account, anywhere from $1 to $25, over a 24-month period.

I selected $10. My $10 monthly payment goes into a locked credit-building account for the next two years. Brigit takes the rest of the monthly payments from the credit building loan and reports my regular payments to the credit bureaus. At the end of two years, I receive my deposits back ($240) into my regular checking account, making this feature an effective savings option while also building credit.

How Much Does Brigit Cost?

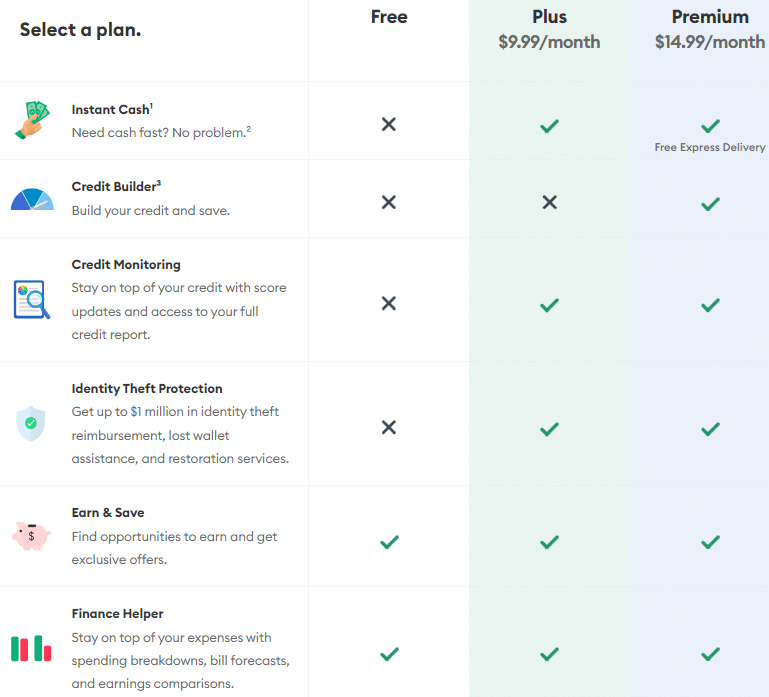

The free version offers bare-bones budgeting oversight and account monitoring features.

For $9.99 per month, you gain access to the Brigit Plus features:

- No-fee, instant cash advances

- Auto advances to help protect you from overdrafts

- Access to your credit report

- Identity theft protection insurance

- Flexible repayment plans: If you can’t pay back your advance on the repayment date, then you can use an extension credit to pay it back later with no late fees attached.

- Earn extra: These are income-boosting opportunities that generally fall into food delivery and online survey categories.

- Finance helper: This feature goes beyond a simple spending habit breakdown and provides past, current, and future financial outcomes based on your income and spending habits.

- Credit builder (Premium ONLY) An installment loan that you pay off over 12 to 24 months. Your credit score benefits from these low, regular payments. And you get your deposited money back after the loan term.

Who Is Brigit Best For?

Do you keep getting popped with $30 to $35 overdraft fees from your bank? Then, Brigit may be the financial app for you. Brigit fights the wasteful overdraft fee battle on multiple fronts for its users.

The free Brigit version vigilantly monitors for a low account balance and sends alerts to you if you’re in danger of overdrawing.

The Brigit Plus plan releases an auto-advance and cushions a low balance to keep you from going negative. Brigit also addresses the root of the problem, which is a lack of oversight of your budget or not enough income, and offers tools so you can better manage your bank account.

Because there are cheaper ways to get a cash advance than paying $9.99 per month, like from the Earnin app we’ll mention below, Brigit is not ideal for people who won’t make use of its budgeting, credit building, and overdraft features, in addition to the occasional cash advance.

Is Brigit Safe?

Brigit uses 256-bit encryption, the same level of protection as your bank. This level of encryption is still impossible to crack by modern computers, so you can feel confident when sharing your bank account login information and Social Security number.

When using the credit builder account feature, you’ll open a locked account with Brigit backed by their partner Coastal Community Bank. This bank is FDIC insured, so your deposits are also insured, up to $250,000.

As far as personal financial decisions go, Brigit puts safeguards to help protect users from going into a deeper debt hole. Only the most financially stable users qualify for a $250 advance, a relatively low amount and only one advance can be taken out at a time.

Brigit Pros and Cons

There is no shortage of fintech apps out there, but Brigit differs in offering a mix of financial products in one place. Here’s more of what we like about the app:

Pros:

- No interest for cash advance

- No late payment fees

- No instant transfer fees

- Credit builder and savings options

- UX-friendly budgeting/spending graphics

While Brigit modernizes old-fashioned budgeting methods, the app still favors traditional employment models. For example, Brigit will take longer to approve you for certain paid features, like Instant Cash, if you’re paid sporadically or have many different streams of income. You’ll also need to make at least $1,000 per month from one client to be approved at all. Here’s a list of other things we dislike:

Cons:

- Limited to $250 cash advance

- Recurring monthly $9.99 cost to access all features

- Limited income booster opportunities

- Only works with U.S.-based banks

- Not freelancer friendly

- May take some time to be approved for a cash advance

- Some user reviews report having trouble getting the app to work or link to their bank account

- Many user reviews report having trouble canceling the subscription service

Brigit Alternatives

Earnin

Some financial emergencies demand more cash than $250. Preferably, you have an emergency fund to pull from. But when finances are stretched thin, Earnin is a cash advance app with unbeatable maximum limits, at $500 for regular users and up to $1,000 for users with an Earnin Express deposit account.

The app is also free to use, so you won’t be handing over $9.99 per month. However, you’ll still need to be paid on a predictable schedule from one main employer.

Earnin is ideal for those who prioritize cash advances for no cost since this platform does not have all the extra financial bells and whistles that Brigit offers. Earnin is also more involved in tracking your income. Beyond employment verification, Earnin tracks your work email, your physical location, or your electronically logged timesheets to determine your hours worked and the maximum amount of cash advance you can take out.

Chime

Chime® came onto the fintech scene in 2013 and has since been a leader in transforming the traditional banking model. Chime offers the following features:

- Visa® Debit card

- Access to Secured Chime Credit Builder Visa® Credit Card

- Get paid up to 2 days early with direct deposit2

Chime also has the SpotMe option for Chime Checking Account holders. SpotMe makes it possible to spot your account anywhere from $20 to $200 without penalty. Anyone who has a single qualifying deposit of $200 or more can qualify for SpotMe.

Chime has no subscription fee, but it’s also not a budgeting app. Instead, Chime offers banking products with no monthly fee, so this may be the fintech company for you if you don’t need a budgeting app.

Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

Frequently Asked Questions (FAQ)

Is Brigit legit?

Brigit is a legitimate financial technology company. Your sensitive personal and financial information is protected behind 256-bit encryption — the strongest encryption standard in commercial use. Brigit’s deposit accounts used for credit building are hosted by Coastal Community Bank and FDIC insured up to $250,000.

How many times can you borrow?

You can borrow an advance as frequently as you’d like, but each advance must be fully repaid before you can take out another advance.

Does Brigit affect my credit score?

A cash advance in the app does not affect your credit score or even get reported to the credit bureaus. Brigit can help improve your credit score through the credit builder account.

Can you cancel Brigit anytime?

Yes. Cancel anytime directly in the app or at hellobrigit.com.

Final Thoughts

Brigit can be worth the price if you fully utilize its budgeting, credit-building, and cash advance features. But it’s expensive so you won’t want to use it long-term. The income-boosting feature isn’t worth paying for – it’s essentially the same time-consuming survey platforms you can find anywhere else online. If you need just one of Brigit’s features, you are likely to find it somewhere else cheaper.

To get an occasional cash advance once or twice a year, try the financial institution you already bank with. It’s better to pay an occasional advance fee for emergencies than an ongoing $9.99 per month.

For budgeting, there are accessible, low-cost financial tools out there that can help you manage a budget and access cash while you build up your emergency fund.

Brigit

Summary

Brigit is an app that can help you budget and allows you to take a cash advance without interest. Costs are reasonable and the mobile app is a big plus.